Top Section/Ad

Top Section/Ad

Most recent

Long seen as adversaries, banks and private credit lenders are getting used to working together

Fahy will also lead asset-based finance origination

Direct lending default rates tick higher amid notable distressed situations

A Swiss borrower has already closed books and Austria's Egger will soon

More articles/Ad

More articles/Ad

More articles

-

Capital market participants with an interest in UK social housing are paying close attention to new UK prime minister Boris Johnson’s appointments to his cabinet and inner circle, to try to gain a sense of his attitude towards housing.

-

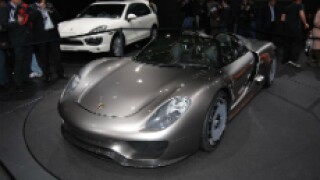

Porsche AG, maker of Porsche sports cars, closed a green Schuldschein this week, with pricing and allocation set for Friday. The final size is rumoured to be €1bn, with an order book far exceeding that.

-

Andrew Hollingworth, a portfolio manager at Holland Advisors and shareholder in Sports Direct, has urged Mike Ashley, the sports retailer’s owner, to pay more attention to corporate governance. But had Hollingworth known about the US private placement market’s experience of dealing with Ashley — in this case over debt owed by one of his other businesses, Newcastle United FC — he might have campaigned for it even more strongly.

-

Fraport, which operates Frankfurt airport and has stakes in several other airports, has entered the Schuldschein market for a second time this year, with an initial target of €200m.

-

The World Bank placed its first Hong Kong dollar deal of its 2019/2020 funding year last week. The supranational chose to link the private placement to the Hibor benchmark, a now little seen structure that was likely the result of a "very specific enquiry", according to one MTN banker away from the deal.

-

Deutsche Kreditmarkt-Standards (DKS), a German industry body, held a conference call with Schuldschein participants on Thursday afternoon to discuss restructuring in the Schuldschein market, and whether there is a case for a standardised collective action clause.