Cartoon

-

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

Improved market and political backdrop tempts insurers to push on with strategic debt capital financing

-

Macron's vision of a sovereign EU appeared closer in bond markets this week, thanks to French political discord

-

A pair of Gulf issuers are considering adding to the resurgence in euro issuance from the region

-

◆ Bank of England launches new dollar programme ◆ Choice of five year discussed ◆ Calculating a new issue premium

-

European sovereign pair showcased the value of the MTN market

-

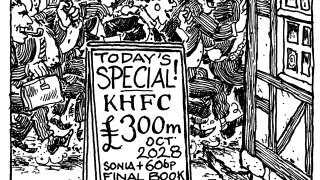

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

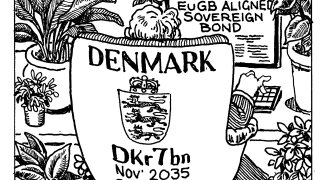

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

◆ Issuer returns after decade absence ◆ 'It’s a very different organisation now,' says person involved in deal ◆ Rare level of demand for sterling bonds

-

Huge financial support eases Pemex's immediate debt risks, but does not cure operational problems

-

-

New funding avenue opened as Vienna-based supra issuer grows