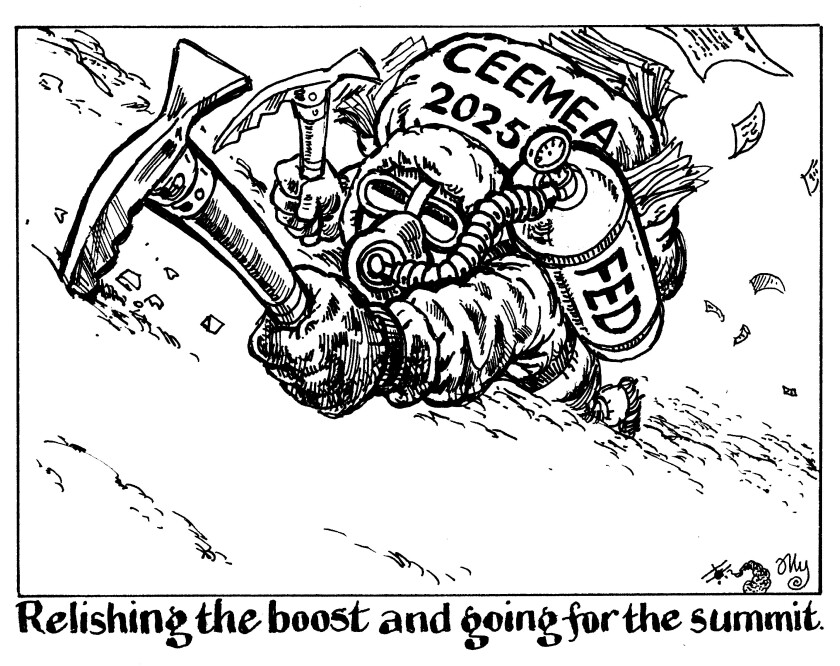

All this year, emerging market bond specialists have wondered if 2025 could be a record year for issuance in central and eastern Europe, the Middle East and Africa.

CEEMEA bond bankers predicted that would only happen if issuers could be persuaded to pre-fund for 2026.

But after the US Federal Reserve cut the Fed Funds rate by 25bp on Wednesday and signalled more cuts to come, hitting the all time high seems almost inevitable.

CEEMEA issuers' dollar and euro volumes are now just $32bn off the record — the $281.3bn printed in 2024.

Last year, $220.7bn had been sold by mid-September. This year, the market is already around $30bn ahead, at $249.6bn.

The year has been a great one for EM bonds. Despite all the uncertainty about punitive US tariffs, volatility has come in small bursts.

Nothing has shut down issuance for whole regions, in the way that has happened in recent years, when Russian issuance ceased, a war in the Middle East erupted, or Turkey’s economic policy took those borrowers out.

Despite the rampant pace this year, not everyone has beem convinced the volume record will fall.

They explained away the issuance velocity by saying issuers had frontloaded borrowing into the early months. Only with pre-funding late in the year would issuance be high, they argued.

But after the US rate cut, with further cuts looking likely, and coupons still high, EM bonds are super-attractive to investors. That makes the market very tempting for issuers, too — including for pre-funding.

It would now be more of a surprise if 2024's record was still intact, come December.

As one banker said gleefully this week: “EM loves a rate cut.”