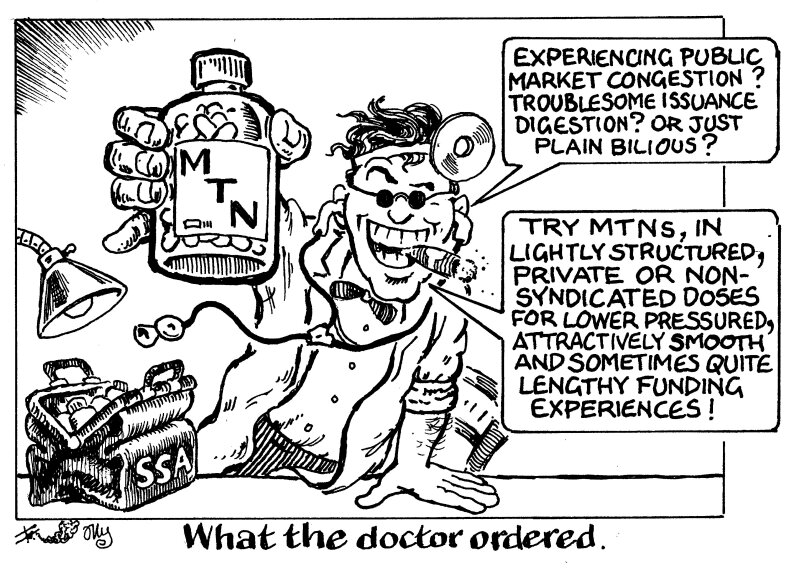

In a world where sovereign, supranational and agency bond issuance is only expected to rise, the MTN market has shown its value.

Private placements and non-syndicated funding can ease the funding pressure for SSAs as public markets grow congested with new debt. Both Belgium and Italy have underlined the importance MTNs have in an SSA issuer's funding repertoire.

Though the MTN market may have lost some of its previous glory — and volume — as market participants have moved ever further into public markets since the 2008 financial crisis in their bid to increase liquidity, this funding route still has value.

This week Italy demonstrated that as it returned to lightly structured issuance with a €700m 10 year collared fixed-to-floating rate note. The deal brought its non-syndicated funding for the year to €4bn, according to GlobalCapital’s MTN Monitor.

This followed a string of dollar notes from Belgium between late August and mid-September which provided $2.1bn of near-10 year funding — almost 5% of the country's long-term gross financing need for the year. The private funding burst has impressed even public syndicate desks given the short execution window and the size raised.

To be able to lighten the load while also providing savings compared to public market funding programmes, as Belgium was observed to have done, has caught the market's attention at a time when governments are facing higher borrowing needs and costs.

Having attained funding outside of their core markets, these sovereigns have branched out to alleviate pressure on their core programmes. Other sovereign DMOs should take heed.