Top Section/Ad

Top Section/Ad

Most recent

Weak or half-hearted response to Greenland threats will leave markets crumbling

Vaccine bond programme to issue $1.5bn this year but needs new pledges

CSFB and Barclays banker epitomised the brilliance and strategic acumen many aspired to

A selection of the clever, funny and weird to keep your mind sharp over the new year break

More articles/Ad

More articles/Ad

More articles

-

Participants at a Transparency Task Force symposium on Monday told representatives of three UK financial regulators they welcomed their efforts to step up oversight of the financial system’s response to climate change — but they called for regulators to be more ambitious, as scientists say the world has 12 years left to get global warming under control.

-

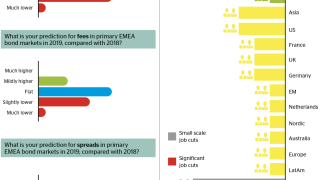

Pain from Brexit, higher interest rates, quantitative easing ending and political strains in the EU will all lead to more volatility in 2019, according to 22 heads of debt capital markets in the EMEA market, including 18 of the top 20, in Toby Fildes’ annual outlook survey. And that’s before Donald Trump, Vladimir Putin and Mohammed bin Salman get going. There is some good news, however: financial institutions are set to be big issuers, and the DCM heads expect to be net hirers...

-

Financial markets are often seen as cold, calculating machines for making money. That is part of their function. But increasingly, people are talking of markets’ broader social purpose — that they exist to serve humanity and make its existence healthier and more sustainable. Toby Fildes argues that, 10 years on from the crisis, this new ethos will govern the markets’ future.

-

Santander has picked up an ex-Deutsche Bank private debt banker for its MTN syndicate desk.

-

JP Morgan has picked up a banker from NatWest Markets to trade sterling SSAs.

-

The first treasurer of the Asian Infrastructure Investment Bank has taken a sell-side job in New York.