Top Section/Ad

Top Section/Ad

Most recent

A selection of the clever, funny and weird to keep your mind sharp over the new year break

European and high yield chiefs to take the reins

More articles/Ad

More articles/Ad

More articles

-

Financial specialists will have two years to work out how to implement the European Union’s Taxonomy of Sustainable Economic Activities, which now looks certain to become law in the coming months. But investors, companies and banks are likely to start using the huge document much sooner than that, in a wide variety of ways.

-

European member states have voted to approve the law introducing the Taxonomy of Sustainable Economic Activities at the second time of asking, after France and other objectors won concessions in favour of nuclear power that pro-green observers insisted were nothing to worry about.

-

HSBC has named two bankers as global co-heads of its debt capital markets team, replacing Jean-Marc Mercier. It is also planning to open two new desks.

-

In 2019, public sector borrowers led the way in the implementation of the new risk-free rates, with Sonia becoming a mainstream product. The question is whether Sofr and €STR can become as widely adopted as financial markets prepare for the end of Libor. Burhan Khadbai reports

-

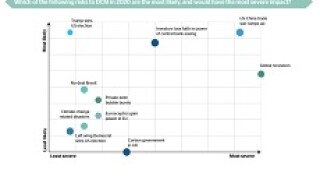

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

Equities are at record highs, rates at record lows; the US is quarrelling, China is slowing. As 2020 begins, participants are divided on which way markets will move. Toby Fildes picks 10 themes