Issues

-

SMG’s drop below offer price sends mixed signals

-

CBA and Nationwide senior bonds push monthly FIG tally to just shy of $80bn

-

Strong captive green demand keeps euro benchmark books sticky

-

There is value in looking away from the dollar market, even if it is not immediate

-

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

Less illustrious issuers may struggle to repeat Qatar bank's outcome, and more expensive euro funding would crimp interest

-

◆ Insurer sells first RT1 before calling legacy tier one ◆ Priced close to or through fair value ◆ Investors bullish on Italy

-

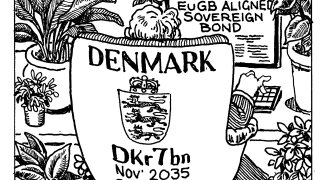

Taxonomy alignment grows, making EuGB label possible

-

Mid-cap equity-linked issuance to grow

-

Mainstream credit investors pile in, reducing reliance on hedge funds

-

◆ Issuer returns after decade absence ◆ 'It’s a very different organisation now,' says person involved in deal ◆ Rare level of demand for sterling bonds

-

Sustainability-linked loan bond increased and gets better pricing than normal in kronor