Issues

-

◆ Staggering demand for Dutch utility ◆ Pricing tightened 80bp from initial thoughts ◆ Volkswagen steers €2bn multi-tranche green deal

-

◆ Dutch bank takes €1.5bn at four years ◆ Little resistance to pricing through 20bp ◆ Sticky book allows for tight final level

-

Issuers still planning to fund €3bn-€4bn in Q4 from green taps and non-core trades

-

-

Firm has added to its London team with seventh partner hire this year

-

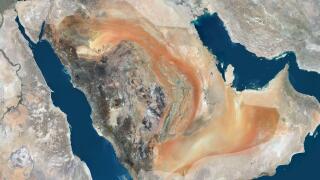

Saudi mortgage provider will offer a premium to its sovereign, and deal will carry a guarantee

-

The emirate could break EM reoffer spread records, and has broken those for CEEMEA

-

◆ Second SP deal from SEB this year... ◆... becomes longest point on its euro curve ◆ Some concession left as 'the right compromise'

-

◆ 'Great result' for Dutch agency ◆ Capped size, social label helpful ◆ CDPQ brought 'very interesting' deal the day before

-

◆ Royal Mail owner sells four and seven year notes ◆ Longer leg attracts the bulk of demand ◆ Bureau Veritas cuts spread by 32bp for €700m eight year

-

Danish wind developer gets faster project restart than Equinor

-

◆ Belgian bank deal attracts biggest book of week so far ◆ Deal bid 2bp tighter, through fair value post-pricing ◆ Treasury accounts drive Wüstenrot bid