Free content

-

GlobalCapital speaks to Barbados prime minister Mia Mottley, whose calls for the world to increase efforts to fight the climate crisis are intrinsically linked to sovereign debt

-

Market participants are invited to give their views on the outlook for the FIG market in 2023

-

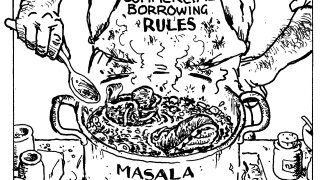

The Masala market has been languishing in a slough of bureaucracy

-

First, the UK government must fix its self-imposed crisis. Then it can assert its leadership in the digital future of finance

-

One Turkish bank expects a third of lenders to drop out of loans this autumn

-

- Who’s in - Who’s out - Who’s paying for it

-

The European Central Bank’s retreat from monetary easing should be nuanced and gradual

-

The Bank of England is hiking blind in a blizzard after the Treasury’s autumn statement delay

-

Take two minutes to respond to eight multiple choice questions

-

New funding entities could help Italy but benefit will be magnified with tighter spreads

-

The hammering of Chinese stocks is ominous, but investors should hold out for a turnaround

-

Market participants invited to choose outstanding performances of 2022