Free content

-

Limited central bank support and an already jittery investor base mean 2024’s year of elections could be rough

-

Sponsored by European Investment BankBertrand de Mazières, Director General of Finance at the European Investment Bank (EIB), retires this year after 17 years at the institution. During an august career he helped guide the bank through periods of global financial crisis and political turmoil. He was instrumental in the EIB’s evolution into a climate bank that has laid the foundations of a trillion dollar green bond market. But in a testament to the institution’s culture, what he will miss most is the people.

-

The ebullient market conditions as 2023 ends are unlikely to last. Issuers must be ready for liquidity to ebb abruptly

-

Letting the biggest issuers test the market in the first two weeks of 2024 could pay off for tiddlers

-

A test case for calling subordinated debt is about to be heard in the court of the capital markets

-

◆ Searching for an ABS 'greenium' ◆ Euro CLO pipeline building ◆ A new golfer in town?

-

Private placements can offer advantages to issuers that put in the work and give up the limelight

-

◆ What the most senior debt bankers in the world believe about next year ◆ Who's eating Credit Suisse ◆ If a property company falls in the forest and doesn't make a sound...

-

After a turbulent year marked by extreme moves in rates and bank failures, GlobalCapital assesses the meaning of these events and how market participants believe 2024 will play out

-

Sponsored by Crédit AgricoleRobust primary supply, currency diversification and a shifting product mix are among the key Crédit Agricole CIB forecasts for European bank issuance next year.

-

The past year has been one of tightening in the capital markets, with central banks throwing easy money supply into reverse. GlobalCapital has chosen these corporate deals as outstanding, for proving either that staggering sizes and difficult maturities were still possible, or that ingenuity and flexibility could make even the toughest market conditions work for an issuer

-

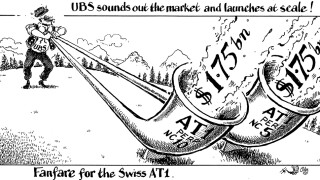

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels