Sovereign supranational and agency borrowers are gearing up for January, which is likely to be the biggest month for issuance all year.

Investors will have cash to deploy and so issuers will want to get their first deals over the line and start eating into their large borrowing requirements. As market participants will often tell you, the first deal of the year can set the tone for the subsequent few weeks and months.

But vigilance will be rewarded next year, as a deluge of supply from borrowers, as well as central banks clearing their balance sheets, threatens to push out euro SSA spreads and macroeconomic data threatens to destabilise the rally in bonds.

This year was characterised by huge volatility as the market tried to guess the path of interest rates. Issuers often found themselves on the wrong side of shifting markets and faced smaller issuance windows than they have been used to.

Interest rate futures prices imply 152bp of rate cuts by the time the US Federal Reserve meets in December 2024, while the dot plot of its members’ expectations for rates last week signalled just three cuts in total in that time.

The 10 year US Treasury is at its lowest yield since July. The Bank of England got some good news on Wednesday too as the latest UK CPI data suggested core inflation had fallen to 5.1%, below expectations.

But this rally has not been tested with issuance, as the primary market all but shut at the end of October, and bankers and issuers cannot say with confidence that they know exactly what investors will be thinking come January.

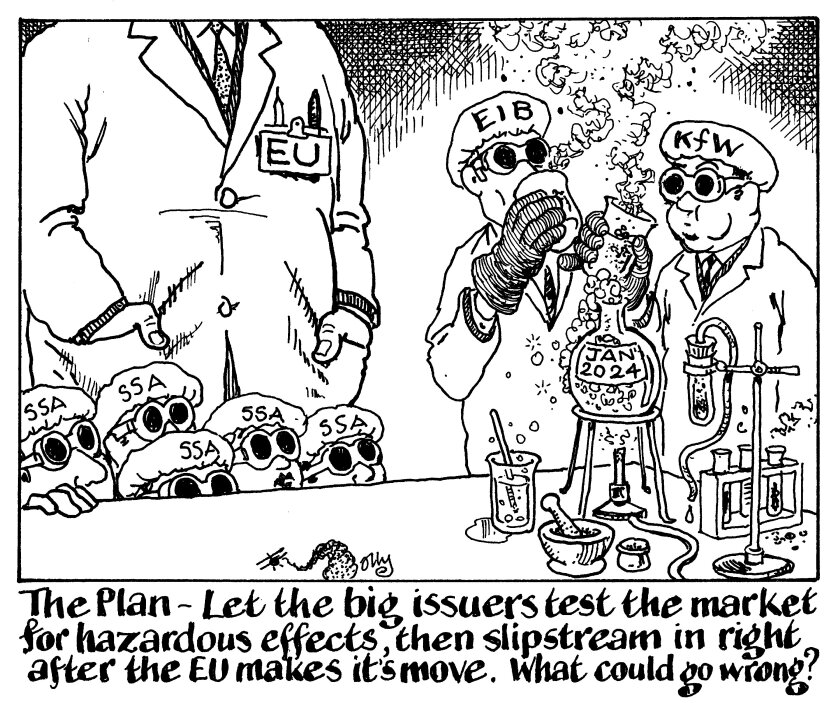

While KfW and the European Investment Bank will no doubt enjoy successful deals at the start of the year, other issuers might want to hold off before jumping in and following the leader, let alone trying to be first themselves. As tempting as it is to let the fear of missing out take hold, smaller issuers, particularly those not offering an interesting spread over larger borrowers, risk getting brushed over should investors decide to take a more cautious approach.

With the European Union’s first syndication set for the third week of January, it might work better for issuers to watch how the market takes down the supply and set their sights on the first window after that.