Free content

-

Europe’s IG corporate bond market is in danger of finding out how many straws it takes to break a camel’s back

-

◆ Primary market for banks flying but will property burst the bubble? ◆ Japan to debut transition bond as SLLs fall out of favour ◆ Kenya back in bond market

-

The product was used lazily, and without understanding its potential

-

Downcast IPO market needs more good deals like Renk and Athens International Airport

-

◆ No need to panic for consumer ABS ◆ Trusting your gut with career opportunities ◆ From the USSR to structured finance

-

If retail investors aren’t getting involved at a time when interest rates are at their highest for a decade and savers are raring to engage, then when are they ever?

-

Blowout bonds and performance in secondary gloss over the fundamental problems the sector still faces

-

◆ VW misses ESG deadline ◆ Good times for ABS ◆ CLO triple-A funds fear fall from power

-

The Awards will celebrate the Banks of the Year and Deals of the Year in EMEA equity capital markets and M&A, which were most impressive in a testing year for ECM as central banks battled against inflation

-

◆ The first of a new asset class in SSA debt ◆ Full inspection of AfDB's landmark deal ◆ A power shift in the European CLO market

-

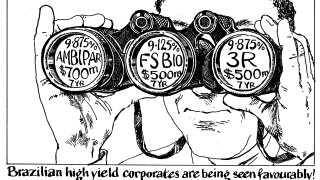

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

The ready and the willing should ride the African Development Bank’s wave while they can