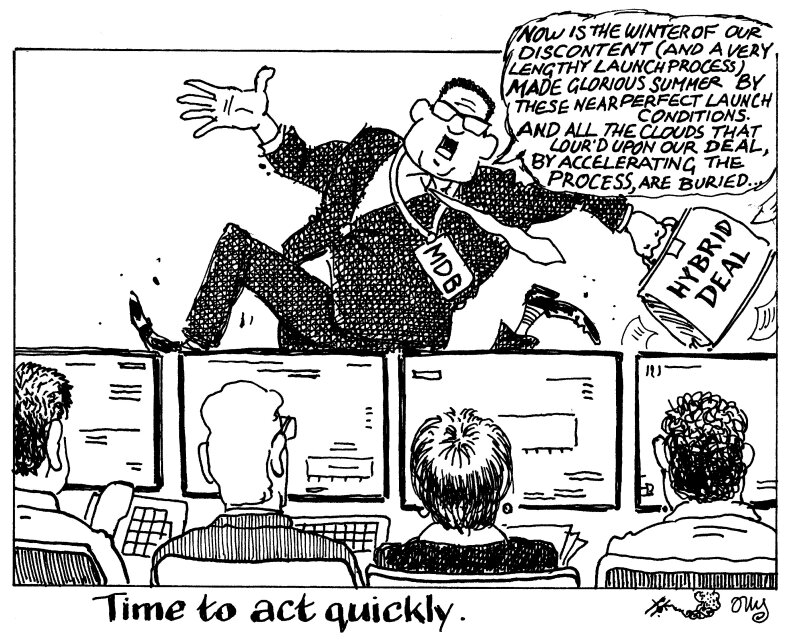

The African Development Bank has shown that it is viable for multilateral investment banks (MDBs) to raise hybrid capital from the public market after years spent putting their landmark transaction together. The pressure on other MDBs to follow suit will be growing even more now the AfDB has priced its trade and there is no better time for these institutions to accelerate their own journeys to market.

Ever since the G20 met in Venice in July 2021 and discussed whether the MDBs were lending enough to the developing world, the call for them to boost their balance sheets and lending has grown ever louder. Cautious, even reluctant, at first, they have come round to the idea that issuing hybrid capital is a good route to do this, spawning a whole new asset class in the process.

Issuing an inaugural hybrid instrument is no simple process. Internal analysis and approvals, winning over the rating agencies, finding and persuading investors, not to mention haggling over price, can take years — two of them, in the case of the AfDB. Each MDB is differently constructed too, meaning cookie cutter term sheets and clauses won't work.

But no conscientious MDB funding team will not have done some groundwork already, and with all products in capital markets, follow-on trades happen more quickly than the first — good ideas catch on fast.

The AfDB attracted more than 270 investors into its $750m 5.75% perpetual non-call 10.5 year bond, with orders peaking at $6bn. Whatever the quirks of hybrid debt, if rates are to fall, as so many investors believe, you would be hard pushed to find that sort of pay-out for such a credit anywhere else.

Therefore, smart issuers will want to print while the market is hot. And the amount of front-loading SSA issuers have done this year shows they understand this — after all, market sentiment can dip at any moment.

Hybrid capital — or any subordinated debt — is arguably a bull market product. It can fall from grace rapidly when market conditions sour.

Patience paid off for the AfDB in assembling its deal and finding its window. But issuance windows are there to be jumped through before they shut, which they will. The diligent MDBs will waste no time in bringing their own hybrids to market.