Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

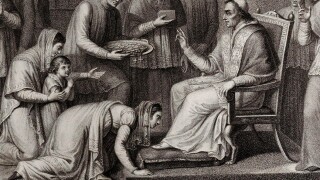

The processes of choosing a new Pope and someone to run Crédit Agricole’s CIB may have more in common than you think

-

United Carton Industries IPO institutional bookbuild covered 126 times

-

The Uzbek miner is taking advantage of a surge in gold prices triggered by Trump's tarifs

-

The gold price has jumped by 7.5% since it first unveiled plans to issue

-

◆ SLBs miss targets with hundreds more up for review ◆ US issuers make hay in European sunshine ◆ Banks probe longer dated debt issuance

-

New issue premiums have risen, but even single-B rated issuers have priced deals

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa