Top section

Top section

Issuance net of buy-backs is not that high, and there is no sign of any indigestion

The country has vast potential, but governance and conflict in the east are the two big headwinds

Ivory Coast squeezed tight, taking $1.3bn in an 'aggressive' execution

Data

More articles

More articles

More articles

-

HSBC Asset Management is unifying its alternatives businesses, creating a single 150-strong team led by Joanna Munro, previously the firm’s global chief investment officer, in London.

-

Nayuki Holdings, a Chinese teahouse chain, is set to launch its Hong Kong IPO on Friday, according to a source close to the deal.

-

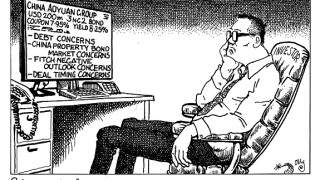

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

VPBank Finance, the consumer finance arm of Vietnam Prosperity Joint Stock Commercial Bank, has returned to the loan market just four months after its last deal. But this time around, it has brought together a diverse mix of lenders to run its fundraising — a rarity for transactions from the country. Pan Yue reports.

-

Credit Suisse has promoted two veteran bankers in its Greater China private banking business.

-

Shanghai Junshi Biosciences has raised HK$2.56bn ($330.5m) in equity capital from a placement of shares that drew a solid response from investors both during wall-crossing and bookbuilding.

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa