Top section

Top section

The country will use all the money raised for liability management

The country is one of the highest regarded sovereign issuers on the continent

The government has been much more proactive in its debt management since a scare in 2024

Data

More articles

More articles

More articles

-

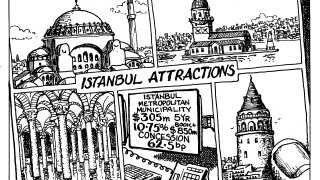

The municipality is the first Turkish non-sovereign issuer since mid-January

-

Russia had been meeting Eurobond obligations but its latest payments have not gone through

-

Transmantaro deal a boost but pricing a deterrent to most LatAm issuers

-

Czech telco Cetin roadshows for deal later in week

-

Investors said Russia's move was smart, and non-sovereign issuers may follow its lead

-

Peruvian quasi-sovereign looks to bond market as América Móvil trades up

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa