Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

Hire follows two senior departures from SMBC

-

-

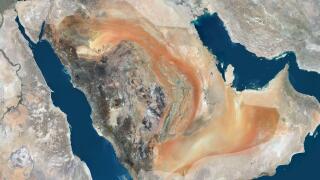

Saudi mortgage provider will offer a premium to its sovereign, and deal will carry a guarantee

-

The emirate could break EM reoffer spread records, and has broken those for CEEMEA

-

Tanzanian bank's second loan in less than 12 months

-

The spread was tight, despite the deal's large size

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa