Top section

Top section

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

Jordanian bank wants to move into investment banking

Very few, if any, Gulf issuers are looking at sterling bonds

Data

More articles

More articles

More articles

-

Toll roads operator Salik is the latest state-owned company set for privatisation

-

Power co is funding buy-back with debt from Guatemalan subsidiary

-

The telecoms firm has cut international debt to 35% of total

-

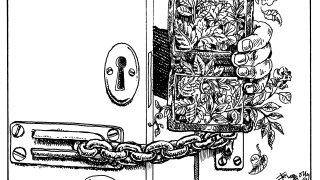

EM issuers with market access do not need cash, while those who need cash have no access

-

We need to broaden the definition of a greenium beyond new issue pricing metrics

-

Euro market does not offer the size or duration it used to

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa