Top section

Top section

Bankers expect another quiet week or two unless sovereigns dip into the market

Bond specialists sceptical that auctions can yield better results than bookbuilding

Inflows so far in 2026 are nearly a quarter of all of last year's figure

Data

More articles

More articles

More articles

-

The main comparables will be bonds from its shareholders such as Taqa and Mubadala

-

Lower than expected inflation in the US has given EM issuers a boost heading into summer

-

Real estate firm eyes the market after a week of US Treasury yield yo-yoing

-

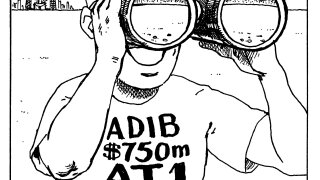

Despite ADIB's success, many EM issuers will be unable to refinance their AT1 bonds

-

The issue comes after a bond exchange offer and payment relief agreement from lessors

-

Spanish bank seizes opportunity of Credit Suisse demise to grow IB

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa