Top section

Top section

Founder of climate investing think tank wants to apply ideas as bond investor

The sovereign rarely issues more than once a year on international markets

Proportion of non-dollar issuance in CEEMEA has grown in 2026

Data

More articles

More articles

More articles

-

Investors want to keep buying new bonds even after record January, but uncertainty over flows could cool demand

-

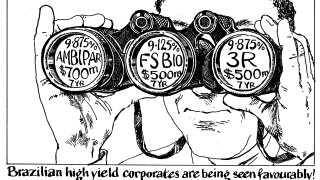

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

Banque Ouest-Africaine de Développement's deal in December will be followed by more this year

-

Confidence of rate cuts to come as issuers keep printing

-

The trade should go well, said observers, after Ivory Coast's success last week

-

Real estate developer is Asia's first bond victim of 2024, after price and book size fail to inspire

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa