Top section

Top section

The sovereign is ramping up overseas issuance, plans to branch out into new currencies

Premium to dollars was in the high single digits, said a lead

The UAE bank capped the deal size at $500m, gaining some leverage over pricing

Data

More articles

More articles

More articles

-

Demand cleared $12bn for the dual sukuk and conventional deal

-

One syndicate banker off the trade was impressed by starting level as orders ballooned

-

The electricity firm is familiar to buyers, despite being a rare issuer

-

The trade might not be the sovereign's only one of the year

-

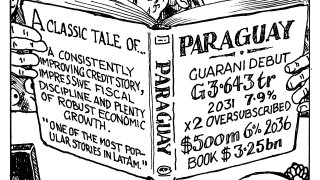

Years of credit improvements have given landlocked country a loyal following among EM investors

-

The countries' euro curves trade at similar levels, but Benin will have to come wider in dollars

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa