Top section

Top section

Japanese government bond yields have risen during the last few months

Attractive pricing versus dollars luring GCC borrowers back to the single currency

The seven year dollar bond's yield will likely be one of the highest in CEEMEA in the last few years

Data

More articles

More articles

More articles

-

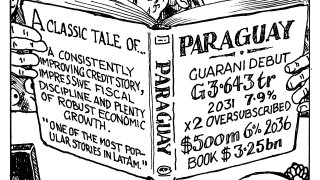

Years of credit improvements have given landlocked country a loyal following among EM investors

-

The countries' euro curves trade at similar levels, but Benin will have to come wider in dollars

-

The issuers are diverse and will not cannibalise demand, said one banker

-

The country rarely issues more than one public bond a year

-

Previous changes of the central bank's governor were unwelcome, but the market was steady on Monday

-

◆ The first of a new asset class in SSA debt ◆ Full inspection of AfDB's landmark deal ◆ A power shift in the European CLO market

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa