Top section

Top section

◆ How banks and bankers are operating in the region under threat of military escaltion ◆ Bond issuance to resume — but how? ◆ Dwindling fee pool poses questions over long-term future for banks

Toto, I have a feeling we're not in EM anymore

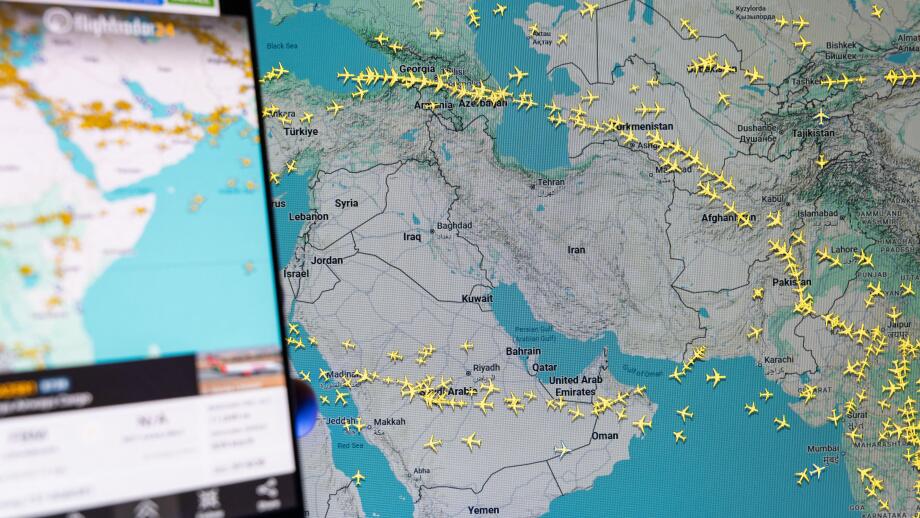

A dozen Middle East bonds postponed as Iran conflict flares

Data

More articles

More articles

More articles

-

Some capital market staff laugh off risks, others worry about their families

-

Gulf debt's safe haven status shaken as Abu Dhabi bond widens 15bp

-

It's easy for investment bankers to get jaded about awards ceremonies, but they are missing the point

-

◆ UAE issuers leave emerging markets label behind ◆ What Blue Owl can teach us about private credit for the masses ◆ A bump in the road for UK bridging lenders on the way to securitization

-

The UAE will leave emerging market bond indices next month but its issuers will not suffer much, if at all

-

Investors are rewarding Romania for trying to fix its fiscal problems

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa