Top section

Top section

Reopening the €1.75bn bond issued in January attracts huge investor interest

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

Jordanian bank wants to move into investment banking

Data

More articles

More articles

More articles

-

About 30% of the deal expected to go abroad as other EM discount retailers will serve as comps

-

Execution impresses as sovereign found itself in sub-par market conditions

-

The CEE sovereign's seven year priced tighter than any from its peers this year

-

The Abu Dhabi Pension Fund, Bahrain's sovereign wealth fund, Emirates International Investment and the Oman Investment Authority have promised to buy shares, with more long-only accounts in the book as anchors

-

New role was created by reorganisation in spring

-

Changes follow arrivals of Raghavan and Mangla from JP Morgan

Sub-sections

-

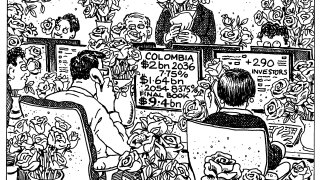

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa