Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

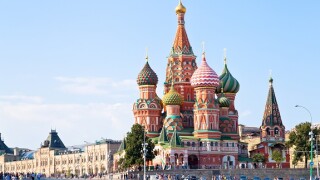

Development bank's credit ratings suffered a blow after Russia's invasion of Ukraine

Books were nearly three times the issue size

◆ Higher rated Austrian lender offers more spread for similar senior preferred bond ◆ Big demand pushes deal inside fair value ◆ BCP still prints its tightest unsecured debt for more than five years

After a record 2024, Turkish corporate issuance slowed last year

More articles/Ad

More articles/Ad

More articles

-

Russian paper and pulp company Segezha is covered across its initial price range in its IPO, showing that Russian companies can withstand political volatility when doing an IPO.

-

Bank of America sold a floating rate note over the Bloomberg short-term bank yield index rather than Sofr this week, as Morgan Stanley added to the post earnings rush in dollars.

-

-

Emerging markets bond buyers and issuers are regaining confidence as US Treasury volatility falls, with issuance in CEEMEA and Latin America having picked up in recent days and a pipeline building.

-

A campaign by a political opposition party questioning the deployment of Turkey’s FX reserves and a snub from the United States has put new pressure on the country’s bonds.

-

Segezha, the Russian paper and pulp company, has set a price range on its IPO despite the growing pressure faced by Russian companies as hostility between the country and the US increases.