Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

Company in 'no doubt' a public trade would have delivered better pricing

As with other private placements from Africa, observers have questioned the merits of the format

Benin reaped the rewards of its sukuk debut last week, and will do so for years to come

Speed possible in the private placement market proves attractive, even if the issuer may pay a bit more for it

More articles/Ad

More articles/Ad

More articles

-

While some cash-strapped borrowers in Africa will bite the bullet and pay up to access international bond markets in 2017, others will have to return to the loan market for support. Virginia Furness and Elly Whittaker report.

-

Shares in Life Healthcare, one of South Africa’s leading private hospital operators, rose 1.5% on Tuesday after it said it would raise R10.7bn ($756m) in a rights issue to reduce its leverage after buying Alliance Medical Group, the UK provider of diagnostic imaging services.

-

In this weekly round-up, the US Federal Reserve interest rate hike is pushing the RMB even lower against the dollar, a fresh batch of free trade zones could be approved for an early 2017 launch, and Tunisia’s central bank is looking at a Panda bond deal. Plus, a recap of our coverage.

-

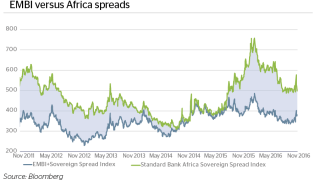

Emerging markets bonds sold off after the US Federal Reserve indicated a more hawkish tone on Wednesday — but much like what happened after the Brexit result, spreads came off their wides quite quickly.

-

Nigeria’s sovereign bond prices have rallied with a new Eurobond expected in January despite the government reporting on Monday N2.2tr ($7bn) of unrecorded debt, equivalent to 2.3% of the country’s GDP.

-

South African gold miner Sibanye has agreed to buy US palladium miner Stillwater for $2.2bn and will raise a $2.7bn loan to pay for the acquisition. Sibanye joins South African borrowers Steinhoff and Aspen in raising large loans for M&A this year.