Currencies

-

◆ Difficult FIG execution was less pronounced in the senior market ◆ New type of offerings from BNP Paribas and Islandsbanki receive strongest reception ◆ AIB's mid range holdco lifts lower volume

-

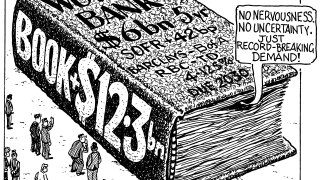

◆ First new benchmark from the issuer in two months ◆ Record IOIs but pragmatism remains ◆ Investors welcome MDBs back in primary after recent Trump noise

-

◆ Nineteen times covered books for €3bn of taps ◆ Shorter, older bonds replaced by long ones ◆ ‘Clever trade’ and ‘very precise pricing’ as a result

-

◆ Priced off recent peer issue ◆ New levels found after swap spread moves ◆ Deal twice subscribed

-

◆ Norwegian lender shows longer tenors are no issue ◆ Investors flock to four times covered deal ◆ Slim premium paid to reopen market

-

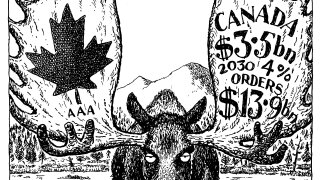

Canada's strong dollar deal suggests investors are looking beyond Trump threats

-

◆ Deal lands after lengthy roadshow ◆ Investors pledge over €1.15bn of orders for sub-benchmark print ◆ Single digit concession offered

-

Issuer expects second deal of same maturity in the autumn, while funding needs may change

-

The solar energy investment company slashes 30bp off part of its loan margin

-

◆ A3 rated name opens wider than BBB euro debutant Galderma ◆ Rewarded with big, sticky book ◆ Attrition still clear in other trades

-

◆ Borrowers pile into the market…◆ …but almost all only for small benchmark sizes ◆ Concessions still small as high demand battles low supply

-

◆ Spread tightening and premium paid were unusual ◆ Strong investor quality as fast money stays away ◆ Bankers do not expect repeat of strong deal