Top Section/Ad

Top Section/Ad

Most recent

New firm mine. aims to build 'institutional memory' for borrowers

When staff complain, they deserve a fair hearing, not a wall of silence

Syndicate and trading executives get wider responsibilities

Weak or half-hearted response to Greenland threats will leave markets crumbling

More articles/Ad

More articles/Ad

More articles

-

Nomura has hired veteran banker Guy Smith as head of DCM and acquisition and leveraged finance for Asia ex-Japan, effective Monday.

-

Green bond issuers could be encouraged with a payment from the government if the bond finances a reduction in carbon dioxide emissions, according to a report for the Swedish government this week.

-

DZ Bank has overhauled its debt capital markets operation and plans to use its sustainable finance credentials to push for more international business, especially in SSAs and covered bonds.

-

Industry members and SEC commissioners put their heads together to address the liquidity issues that face the fixed income markets in the first US Fixed Income Market Structure Advisory Committee.

-

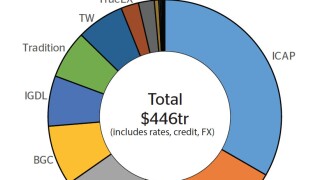

Five years after being pushed on to trading venues in the US by the Dodd-Frank Act, over-the-counter derivatives players are beating a similar path in Europe, under the Markets in Financial Instruments Directive II. Most people think MiFID II has been a worse experience, and will make it harder for small players. But efficiency gains may follow. Ross Lancaster reports.

-

When the shadowy figure known as Satoshi Nakamoto launched bitcoin in 2009, few predicted that the technology underpinning it would, in a few short years, be hailed as an invention as important as the internet. Capital markets are on the front line for disruption, writes Lewis McLellan.