Top Section/Ad

Top Section/Ad

Most recent

New firm mine. aims to build 'institutional memory' for borrowers

When staff complain, they deserve a fair hearing, not a wall of silence

Syndicate and trading executives get wider responsibilities

Weak or half-hearted response to Greenland threats will leave markets crumbling

More articles/Ad

More articles/Ad

More articles

-

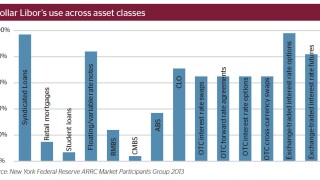

It is six months since Andrew Bailey, head of the UK financial regulator, set the clock ticking on a transition from the London interbank offered rate to an alternative. But if credible replacements are to be ready by his 2021 deadline, there is still a mountain of work to do. Ross Lancaster explores the risks of phasing out the old benchmark and asks if it could yet survive.

-

Banks and other financial firms operate in complex lattices of regulation. But for any firm based in the UK and operating internationally, Brexit means they have no idea what regulations will apply, come March 2019. They cannot afford to do nothing, yet do not know what to plan for. As Nigel Owen reports, the response has been to plan for every scenario, including relocation from London.

-

MiFID II rips up the market rulebook — and replaces it with a whole bookshelf of new rulebooks. Entire divisions have worked flat out to get ready for the regulation’s official start on January 3, and it’s certain to overturn the established competitive order. Nell Mackenzie looks at the winners and losers.

-

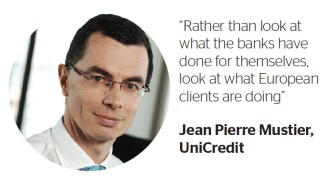

2017 saw some serious capital raising by European banks. Four European globally systemic banks, in four monster rights issues, raised more than €30bn — partly to deal with non-performing loans and partly to reclaim their places in global investment banking and capital markets. Even banks that did not turn to the equity markets sought to conserve capital — but is 2018 the year when belts will start to be loosened again? Owen Sanderson reports.

-

MiFID II might qualify as one of the wonders of the modern world. At 1.5m paragraphs, including all its appendages, it swathes a blanket of mind-numbing verbiage around activities that were once fast and exciting.In that sense, it is the embodiment of modern financial markets and of modernity itself. By Jon Hay.

-

Marguerite Bérard-Andrieu is leaving BPCE, having been chief executive for a year and a half. The bank's board has appointed François Riahi to replace her, from the new year.