Commerzbank

-

China Development Bank Hong Kong gave investors a dual option on October 27, issuing a five year dollar bond and a three year euro deal, finding space in a crowded market that saw six other trades hit the screens.

-

-

Informa, the UK events and publishing company, has completed its £715m rights issue, which it launched in September to partly finance its £1.2bn takeover of Penton, a US competitor.

-

A fourth issuer of the week has broken its record for longest dated syndication ever, while the European Financial Stability Facility wrapped up its 2016 needs with a trade that looked almost short end by comparison to the rest of the week’s euro supply.

-

Austria was richly rewarded for taking a leap into the unknown on Tuesday, as it took orders of over €7bn for the longest dated syndication ever from a core eurozone sovereign. KommuneKredit also broke its tenor record in euros, while the European Financial Stability Facility hired banks for a tap of a bond that looks short end by comparison.

-

Austria is looking to stretch its curve to hitherto untapped lengths, as it mulls a 70 year euro benchmark. Also seeking duration, Rentenbank pushed out its curve, printing a bond at 20 years for the first time ever.

-

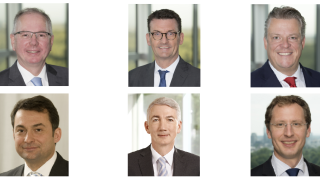

Sponsored CommerzbankWill Frankfurt be the main beneficiary of Brexit? It is certainly working hard to develop its Finanzplatz and polish up its image as a place to live and work. In this roundtable, a who’s-who of representatives from the Frankfurt region exchanged their views on the prospects for the city in the post-Brexit era.

-

The long end will stay very much in vogue for euro issuers next week — which SSA bankers are predicting could be the last big window of issuance for the year.

-

The debut covered bond of BNP Paribas Fortis and the first in four years from SNS Bank were priced on Monday with virtually no new issue concessions and healthy levels of subscription.

-

Poland cemented its position as one of CEE’s most nimble and savvy issuers on Tuesday by printing a 30 year euro deal — only the second ever from a non-Eurozone sovereign — in an opportunistic trade.

-

Valmet — Segro — Ecom — Aluminium Bahrain — Morpho

-

TUI AG, the German tourism company, on Wednesday became one of only five double-B rated borrowers which have been able to print sub 2.5% coupons this year.