Our top stories this week:

The Shenzhen-Shanghai Stock Connect launched on December 5, ending a long wait for the expansion of the original Shanghai Connect. An ETF Connect is next, according to HKEX.

The Chinese Ministry of Finance completed its second offshore RMB (CNH) auction in Hong Kong on December 8, although the outing gathered less demand than the one in June this year.

The Shanghai Municipal authority priced the first bond in the city’s free trade zone open to international investors, with three international banks acting as underwriters on an onshore China sub-sovereign bond for the first time.

Meanwhile, the China interbank bond market direct access (CIBM Direct) scheme is gathering steam as more and more institutions join. In Luxembourg, the local regulator has also given the green light to Ucits funds seeking CIBM Direct access.

FX markets:

The RMB had another eventful week despite the broader dollar rally taking a breather. News on December 7 of a $70bn drop, or 2%, to $3.05tr in China’s foreign exchange reserves in the month of November are also likely to cause more jitters in the market in the days ahead. The People’s Bank of China set the dollar-onshore RMB (CNY) fix at 6.8972 on Friday, 241bp down from a day earlier.

In the spot market, the CNY was trading 0.12% down at 6.8994 as of 10.35am, while the offshore RMB (CNH) was flat on the previous close at 6.9164.

The Thomson Reuters CNH index (RXY), based on a trade-weighted basket of currencies, closed at 95.16 on December 8, 0.6% weaker in the week.

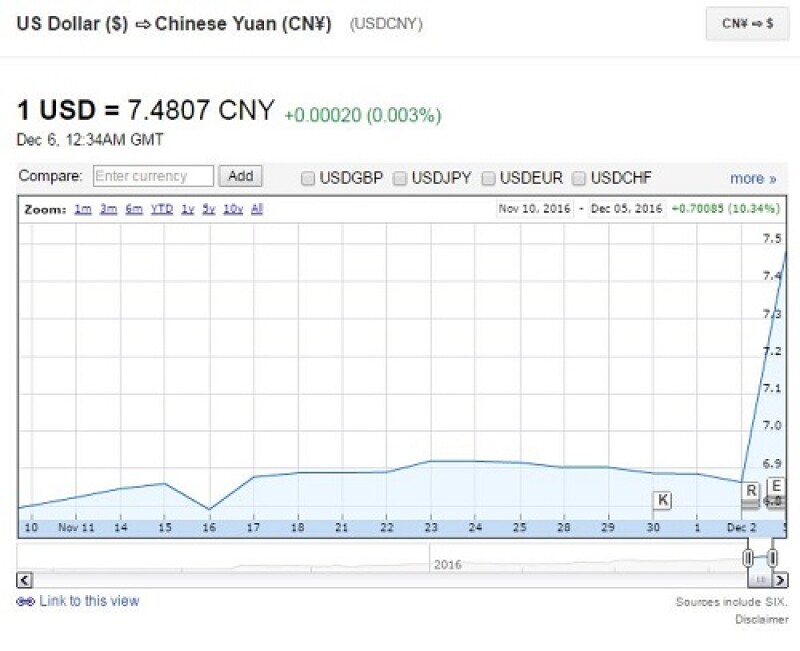

As if real markets were not exciting enough, a glitch in the ICAP platform as well as those of other market data providers showed the RMB dropping 10% to 7.5 against the dollar earlier this week (see chart below). The providers have since addressed the issue but are still investigating the causes. Media reports noted that faulty feeds from unnamed financial institutions may have been behind the glitch.

China Foreign Exchange Trading System (CFETS) granted onshore FX market access to offshore entities include Bank of China Paris branch on November 30, and the Hong Kong branch of China Merchants Bank on December 5.

FX policy:

CFETS issued another anonymous post from a ‘Guest Commentator’, widely understood to be a PBoC spokesperson. The post noted that the CFETS RMB exchange rate index closed the month of November at 94.68, up 0.49% from the end of October.

The other two indices, one based on the Bank for International Settlements (BIS) basket and the one based on the special drawing rights (SDR) basket closed at 95.95 and 95.26, gaining 0.93% and losing 0.27% from the end of October respectively.

The post underlined the impact of recent dollar moves.

“Since the beginning of November, affected by a number of factors such as further recovering US economy and the optimistic atmosphere resulted by Donald Trump winning the US 2016 election, market expectations of the Fed raising interest rates in December was strengthened. What is more, market participants also adjusted their estimates of the extent and frequency of Fed’s future rate-hike. Influenced by the changes of external environment, RMB also depreciated 1.69% against US dollar in November. However, this depreciation is relatively small compared with other major currencies.”

In November, Japanese yen, euro and Swiss franc depreciated 8.42%, 3.57% and 2.78% against US dollar respectively, the post noted. As for the future, the FX policy line was not changed.“In general, the RMB exchange rate has good conditions to remain basically stable at an adaptive and equilibrium level,” the CFETS post noted.

Exchanges:

The Singapore Exchange released its November monthly statistics, showing that USDCNH futures volume was 98,145, up 78% month-on-month and up 179% year-on-year. In other markets, the FTSE China A50 Index Futures remained the most active contract on SGX, with volume of 6.4m, up 53% month-on-month and down 2% year-on-year.

The Taiwan Futures Exchange (Taifex) said it had listed on December 1 new futures and options contracts for an exchange traded fund (ETF) linked to China’s stock market – the Capital SZSE SME Price Index ETF. The underlying ETF tracks A-shares of small and medium enterprises listed on the Shenzhen Exchange.

Taifex also said in a monthly report that its USDCNH futures contract saw 4,870 contracts traded in November 2016, down 3.5% from a year earlier, with average daily volume (ADV) of 408 in the first 11 months of the year. USDCNH options saw 1,301 traded, with ADV of 81.

Trading solutions provider Fidessa said that 17 Hong Kong-based brokers were already using its platforms for the Shenzhen Connect after the December 5 launch.

"Connecting to Shenzhen is a natural step, particularly for those already connected to Shanghai," said Eva Fu, product marketing manager, Fidessa, in a statement. "The two Connect programmes are accessible through the same channel, and we will provide algorithmic capabilities geared to the shape of the Shenzhen market."

The Shenzhen Connect had a quiet first week, with daily usage rate of the net trading quota of just 15.6%, or Rmb2bn, in the first four days since launch.

Bond markets:

Russia is moving forward with plans to issue treasury bonds denominated in RMB for the first, according to media reports published on December 7. Quoting Sergei Shvetsov, deputy governor of the Bank of Russia, the reports noted that the central bank will conduct a roadshow in Shanghai starting on December 22.

Hubs:

Bank of China (BoC) said on December 7 that it had been chosen by Bank of Namibia (BoN), the country’s central bank as the sole settlement agent for its investments in China’s bond market. BoN signed the registration form to access the CIBM on November 3, PBoC approved the application on November 21, BoC said in a statement. In 2014, the Namibian central bank became the first African central bank to open a renminbi clearing account with BoC, the bank added.

PBoC and the Central Bank of Egypt signed a bilateral currency swap line on December 6 worth Rmb18bn ($2.6bn). PBoC said in a statement that the swap line is designed to facilitate bilateral trade and investment, and safeguarding the financial stability of the two countries. The swap agreement is valid for three years. PBoC has 35 active swap lines totaling Rmb3.12tr, according to GlobalRMB data.

Turkish state media reported that Industrial and Commercial Bank of China Turkey Bank, ICBC's local subsidiary, had activated the existing Rmb12bn RMB-lira swap line between China and Turkey on December 8. The swap line was signed in November 2015. The ICBC Turkey transaction was conducted on November 30 and was worth $133m. Swap lines are meant to support trade and investment in situations where open market liquidity conditions are not be able to fulfill demand for either of the two currencies.

RMB clearing transactions in Hong Kong in November bounced back to Rmb18.11tr, the second highest level this year and up 24% on a monthly basis.

Chart of the week - glitch or glimpse?

Source: Google Finance