China

-

Originator hired to go after bank bond issues in euros and dollars

-

-

Chinese government and a bevy of Indian and Korean issuers found conditions sweet for international bonds

-

Company moves from asset seller to European independent power producer

-

First FX swap settled intraday as blockchain trials spread to more asset classes

-

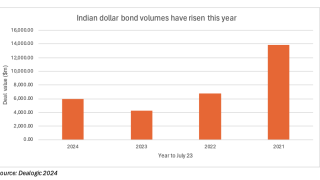

Innovation, strong execution and supply dearth benefit Indian issuers

-

Asian dollar bonds fell in the aftermarket this week, even with new issue premiums

-

Deal boost does nothing to dispel long-term doubts

-

Issuer plans ‘one liquid benchmark every year’ and to frequent a market providing ‘value’ and ‘flexibility’

-

Singaporean bank pulls off ‘incredibly well received’ bank capital bond as record low spreads prove appealing

-

Crowd of issuers finds deal windows as backlog starts to clear

-

Car rental firm addresses upcoming maturity, piquing fresh bond interest among other firms