British economist John Maynard Keynes famously wrote more than 80 years ago that people’s behaviour in the financial world is often driven by “animal spirits” that suggest “spontaneous optimism rather than mathematical expectations”. The craze for special purpose acquisition company listings in the past year is a good example.

Spac IPO volumes surged 5.5 times from $15bn in 2019 to $83.48bn last year, according to Dealogic. The volumes so far this year have already surpassed $100bn; the vast majority of the deals come from the US, which accounts for over 40% of the global IPO market.

There is good reason for the extraordinary boom in Spacs. Also known as blank-cheque companies, Spacs provide a way for high-profile business people to list shell companies – and raise money from investors – if they plan to make an acquisition within two years.

The premise is simple. If no company is acquired before the deadline, investors are refunded their money. If a deal does take place — a process often referred to as de-Spac — it enables the target company to go public while avoiding the hassle of detailed disclosures.

The benefits are many. Spacs offer investors an attractive value proposition, given they receive shares and free warrants; as the target valuation is fixed and negotiated privately beforehand, there is less volatility after the IPO; Spacs offer a listing route for companies that otherwise would not be able to pull off a normal IPO; and investment banks benefit from the juicy fees on offer for the transactions and the follow-through M&A.

But in recent weeks the Spac party in the US appears to be slowing. The number of Spac listings and filings has declined from the heady days of the first quarter this year, while the secondary market performance of many listed Spacs has also been lacklustre. The large number of Spacs hunting for acquisitions is also fanning fears over botched deals and lofty M&A valuations.

Regulators too are flexing their muscles. The US Securities and Exchange Commission’s Gary Gensler, who took over as chairman in April, said the surge in Spacs has raised some critical questions, including if investors are being protected appropriately — comments made in a government testimony in late May.

Gensler added that a study showed worrying trends: that Spac sponsors generate “significant” dilution and costs; that Spac sponsors generally receive 20% of the shares; and that early stage investors stand to benefit the most once a target is found, usually at the expense of retail investors.

All these developments come at a time when exchanges in Asia — fed up with seeing Asia-sponsored Spac business going to the US — are racing to set up the infrastructure to support these IPOs.

Does the growing oversight and waning investor interest mean that the Asian exchanges seriously considering Spacs — such as Hong Kong, Singapore, Indonesia and recently India — should put these products on the backburner? Probably not, but investment banks should go into the market with their eyes open.

In the short term, banks will have to navigate plenty of difficulties. These include the impact on Asia Spac valuations and pricing because of the changing attitude among investors in the US, and how best to navigate the stricter regulatory regimes widely expected among Asia’s exchanges.

But there will also likely be longer-term risks, beyond finding the right M&A targets on time.

A handful of US-listed Spacs have been sponsored by Chinese fund managers. But many banks are focusing on what appears to be growing appetite among China’s technology companies to set up Spacs. Many of these could list in Hong Kong if the bourse paves the way for such deals, leading to possibly big paydays for investment banks.

There may be roadblocks here. While China’s regulators haven’t widely disclosed their views on Spacs yet, given the hard stance taken against technology companies so far, Spac listings by tech names could become a flashpoint.

There is also China’s long-standing focus on protecting retail investors — similar to the approaches in Hong Kong, Singapore and India — and limiting the use of riskier structures. Given their general lack of transparency and relatively poor retail investor protection, Spac IPOs would be a grey area at best, and one that China’s regulators may be hard-pressed to support whole-heartedly.

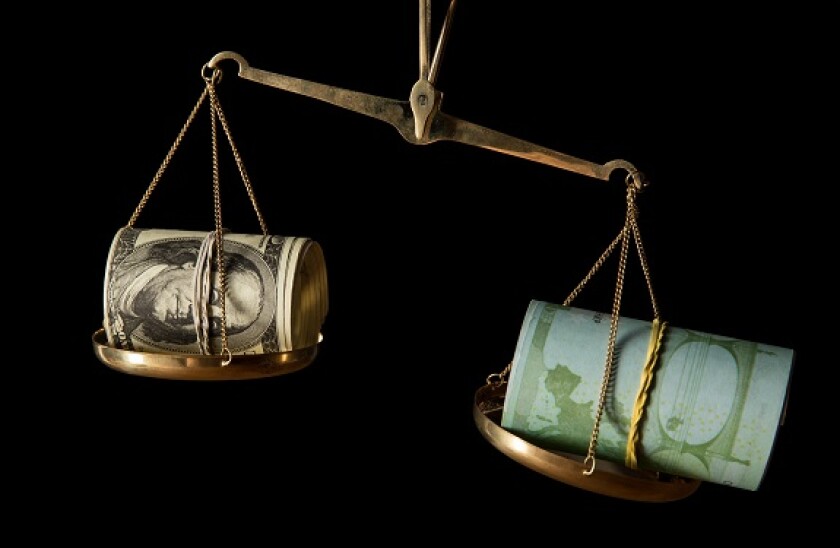

Fees from Spac IPOs, and their subsequent M&As, may be mouth-watering for banks looking at opportunities in Asia. But will the rewards balance out the possible risks that may come from supporting these deals? That’s a big question.

A similar version of this piece was first published in Asiamoney.