Covered Bonds

-

◆ Bank issuers and investors anticipate EBA report on regulatory equivalence ◆ Mediobanca enters its Monte dei Paschi era ◆ The case for not keeping Russia's money

-

Pfandbriefzentrale prints the week’s largest deal with its covered bond programme

-

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

-

Sponsored by Nordea Asset ManagementAmid market volatility, shifting rate regimes and geopolitical uncertainty, institutional investors are turning to fixed income instruments that offer safety, liquidity and resilience. Covered bonds excel across all three criteria, and no investor has more expertise in the asset class than Nordea Asset Management. Distinguished by its size, skill and strategy, the firm was a standout winner in the Covered Bond Investor of the Year category. GlobalCapital spoke to Henrik Stille, the firm’s Head of Fixed Income Rates, about Nordea Asset Management’s approach to the market and why covered bonds are attracting sophisticated capital on the hunt for alternatives to sovereign and corporate debt.

-

Two consent solicitations would restructure programme after acquisition last year

-

Downgrade 'pretty much priced in' for French bank and covered paper

-

◆ Second Friday print in two weeks ◆ Dynamics suggest repricing is almost completed ◆ No premium paid to recent UK building society prints

-

Demand supported by resurgent asset manager bid

-

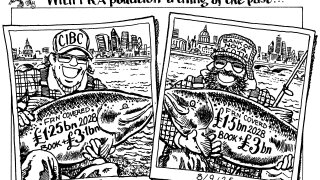

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

Paper could arrive on Monday or Tuesday, ahead of flagship covered market event

-

◆ Deal attracts granular book for a Pfandbrief ◆ Premium paid but outcome still 'fair' ◆ Elsewhere, Finnish sub-benchmark deal proves popular

-

◆ UK lender builds demand across two legs ◆ Equivalence 'noise' no problem ◆ Canadian paper provides the closest, most recent comparables