Top section

Top section

Recent primary deals were well received, but some fatigue is creeping in as new deals line up

Treasury director Rodrigo Robledo says investor relations work has paid off

◆ 'No investor pushback' at tight spread over govvies ◆ Tenor was longest possible ◆ Private placement opportunities

Data

More articles/Bonc comments/Ad

More articles/Bonc comments/Ad

More articles

-

For those hoping that the EU, with its swollen borrowing programme since the pandemic, could become a common European safe asset, the wait may take a little longer as the issuer works to establish itself as a sovereign-like entity and the bloc struggles to make progress on Capital Markets Union. Addison Gong reports

-

-

Some bankers were surprised, others not, but all expect a reduced EU funding programme for 2024's second half

-

German issuer's return partly due to continuing volatility caused by the French election

-

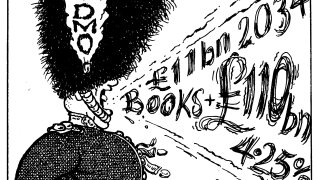

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

Canadian issuer taps into three different currencies within one week

Sub-sections

-

Sponsored by Islamic Development Bank (IsDB)

Sukuk market’s next chapter: Financing the future, sustainably

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa

-

Comment