Top Section/Bond comments/Ad

Top Section/Bond comments/Ad

Most recent

Inaugural government deal could come in late 2026 or early 2027

◆ New 20 year Bund launched into popular demand ◆ Is 20 years the new 30 years for EGBs? ◆ Fair value in debate

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

issuer identifies 'most important' syndication metric amid rising international interest

More articles/Ad

More articles/Ad

More articles

-

We would welcome your feedback on the outlook for the SSA market

-

Several public sector borrowers brought well received deals this week

-

French bond markets were blasé despite the prime minister's shock resignation

-

Issuer to price seven year tap and new 15 year line as France loses its prime minister, again

-

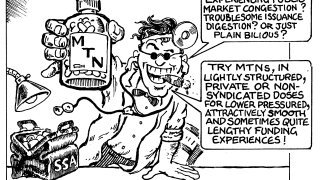

European sovereign pair showcased the value of the MTN market

-

Chunky collared FRN expands sovereign's private funding for the year to €4bn