Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

Sterling deal securitizes two data centres in Slough

International interest for German paper has grown

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Issuer's first green benchmark in 2026 ◆ Blended premium estimated ◆ Central bank/official institution allocations 'notable and high' for green label

More articles/Ad

More articles/Ad

More articles

-

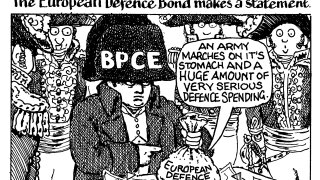

If you want peace, financially prepare for war

-

◆ Novel deal first of a kind from a non-SSA issuer ◆ Delivers 'political message' in readiness for defence financing ◆ Bankers debate whether issuer paid 'generous' concession

-

Headline risk ‘doesn’t tamper with the appetite for SSA products’ at the moment

-

◆ Deal is first since French PM called confidence vote ◆ Some concession left on top of wider secondary levels ◆ Bankers call French covered paper 'attractive'

-

◆ Spanish borrower brings another green print to euros ◆ Peak orders more than three times deal size ◆ Tight spreads persist for IG corporates

-

Markus Stix explains the sovereign's approach to recent euro syndication