Top Section/Ad

Top Section/Ad

Most recent

Record fundraising in 2025 has left private lenders fighting for deals

Best deals, banks, investors, advisers, law firms and tech providers of 2025

More articles/Ad

More articles/Ad

More articles

-

Trig, the London-listed renewable infrastructure investment firm, has signed a £500m loan with its margin linked to Sonia rather than Libor, as loans bankers try to encourage borrowers look at their loan documents soon to avoid bottlenecks next year.

-

After four years of the US government noisily refusing to protect humanity from climate change and pushing back on responsible investing, sustainable finance supporters are full of hope that Joe Biden’s presidency will shift the US — and the world — in the right direction. Jon Hay reports

-

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

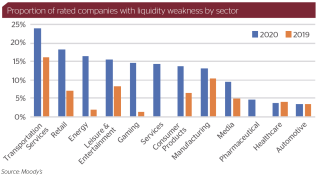

There could be more large restructurings in Europe in 2021 than ever before, as companies seek sustainable capital structures after 2020’s rash of emergency financing. But it’s also a new horizon for the laws that govern restructuring, as countries replace a patchwork of dated and difficult insolvency regimes, and the UK exits the European Union, ending automatic recognition of its court rulings. Owen Sanderson reports.

-

Nick Jansa turns up at Canadian pension fund — Rocket man touches down at Citi — Credit Suisse hires Gaurav Arora

-

The European Commission’s plans to tackle the mountain of non-performing loans that are expected next year as government support schemes roll off have been criticised as unambitious. They have been dismissed as containing little beyond a review of proposals that have already been unveiled.