Issues

-

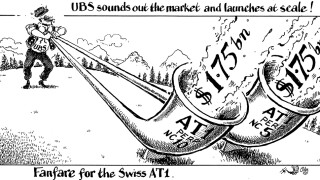

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

The public sector bond market is set for another busy year, meaning congested issuance windows and spread volatility against an uncertain macroeconomic and geopolitical backdrop. But higher yields and a normalisation of demand, thanks to quantitative tightening, present opportunities for both issuers and investors, writes Addison Gong

-

Covered bond benchmark issuance in euros had reached €175bn by early November 2023, suggesting the market was on track to reach €185bn for the year — somewhat less than 2022’s record of a little over €200bn. Although gross volumes are expected to decline a little in 2024, they are likely to remain well above average and, in the absence of central bank support, further pressure on spreads is expected.

-

Financial institutions’ funding requirements point to a busy start to their bond sales in 2024. But, as Atanas Dinov reports, banks may need to compete for attention not only with other financial credits but with the broader fixed income universe, as we reveal the results of our FIG market survey

-

A late year rally in US Treasuries sparked optimism in a Latin American cross-border bond market that has been sluggish for two years. But GlobalCapital’s survey of senior LatAm bond bankers at 17 DCM houses shows observers are far from certain what the revival will look like and what will drive it.

-

Amid the disruption caused by rising rates, buyers and sellers refused to agree prices for mergers and takeovers. That left banks fighting for scraps of deals and feeling the squeeze on pricing. But as Ana Fati reports, since the summer the mood has changed and loans bankers are feeling wanted again. 2024 holds promise, but no one expects an easy ride

-

After a disastrous 2022, hopes were sky high among banks, issuers and investors in the emerging markets that 2023 would mark a turnaround. Record breaking volumes were printed in the first month of the year — and then the first quarter — only for bullishness to fall away as US regional banks and then Credit Suisse threatened another global financial crisis. Conflict in Ukraine and Israel brought further worry. Wise issuers took windows when they appeared and played to their particular strengths rather than waited for the perfect moment.

-

If it is true that interest rates are near their peak, then hopes of a rebound in the IPO market after another dreadful year may be justified, writes Aidan Gregory. But it will be a while before a full normalisation

-

GlobalCapital asked the heads of debt capital markets at over 50 of the top bond houses where they saw threats and opportunities for 2024. Geopolitics are once again at the top of the worry list but so is retaining junior staff. Overall, however, Toby Fildes and Ralph Sinclair, discovered an optimistic tone, no doubt helped by the pervasive belief that interest rates are at or near their peak

-

A cash-heavy Islamic investor base starved of supply — compared to what conventional buyers were served up — helped Middle East and North Africa sukuk issuers secure bigger order books, giving them more pricing power than regional peers issuing regular bonds, writes George Collard

-

Central and eastern Europe sovereigns enjoyed big demand for benchmarks at the start of 2023 but paid high new issue premiums. This was reversed later in the year, as investors became more confident about the path of interest rates and when borrowers had less to raise. George Collard reports

-

If 2023 was a better year for CEEMEA bond issuers it is no great claim; 2022 was dreadful. But investors have gained a degree of comfort over the path of interest rates, giving hope — but not confidence — of a further rebound in the primary market in 2024, write Francesca Young and George Collard