CEEMEA Financial Institution Bond of the Year

Abu Dhabi Islamic Bank

$750m 7.25% perpetual non-call January 2029

Global coordinators and structurers: HSBC and Standard Chartered

Bookrunners and lead managers: ADIB, Citi, Emirates NBD Capital, First Abu Dhabi Bank and JP Morgan

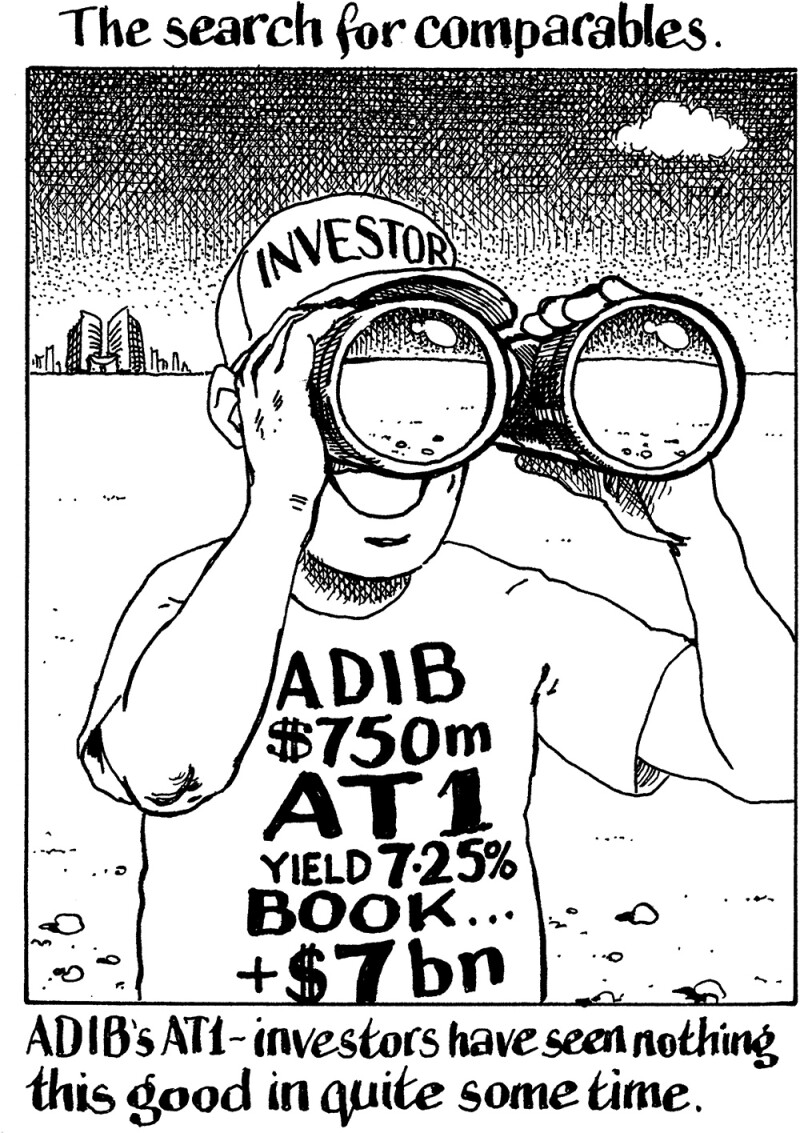

The strength of demand for Abu Dhabi Islamic Bank’s AT1 bowled the issuer and its leads over when they braved the market in July to print the first EM AT1 since Credit Suisse’s collapse — including the writedown of $17bn of its AT1 paper — earlier in the year had upset the market.

When the Swiss regulator wiped out Credit Suisse’s AT1s, trust in the product appeared to have vanished. But despite that, ADIB drew a spectacular $7bn of orders for its AT1 sukuk. The coupon was just 12.5bp higher than a $750m AT1 deal it sold in 2018, despite US Treasury yields having shot up since then by roughly 110bp. The deal was also priced well inside AT1s from even some developed market issuers.

The deal refinanced an AT1 with a looming call date for ADIB — an investor-friendly move that also helped rebuild trust that had been lost in the market more broadly.

ADIB showed that investors were willing to look at borrowers and their debt loads on their own merits, and that being a part of the emerging market universe of borrowers was no hindrance when looking for bank capital.

CEEMEA Sovereign Bond of the Year

Republic of Hungary

$1.5bn 6.125% May 2028s, $1.5bn 6.25% September 2032s and $1.25bn 6.75% September 2052s

BNP Paribas, Citi, Deutsche Bank, Goldman Sachs and JP Morgan

Those heady months at the start of 2023 offered a window where EM bonds came in good size to an investor base that believed — it transpired, incorrectly — that the market was on the brink of a turning point both for US rates and a resurgence of enthusiasm for the asset class.

Hungary was not to know how 2023 would play out when it printed the first CEEMEA bond of the year on January 4. But having seen how emerging market issuers had struggled in 2022 and having built a book of $6bn, it chose to price a total of $4.25bn new bonds, its largest ever dollar bond and largest ever intra-day offering. It paid just 10bp-25bp of new issue premium on each tranche to do it, a far skinnier concession than the 40bp-50bp that other issuers had paid in the preceding months.

By being quick to issue and front-loading its borrowing, it also paid less than other borrowers that waited as 10 year US Treasury yields rose. They went as high as 5% by October but were only 3.69% when Hungary came to market.

Not everyone expected such an impressive result for Hungary but it began a record breaking January for CEEMEA issuers — particularly striking, given the damp squib of a year before — and also started a trend of CEE sovereigns accessing the dollar market. Hungary laid a foundation of confidence among beaten down investors that other issuers took advantage of for most of the first quarter.

CEEMEA ESG Bond of the Year

DP World

$1.5bn 5.50% September 2033

Citi, Deutsche Bank, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, JP Morgan and Standard Chartered

New issues with a decent order book, timed perfectly and with textbook execution were hard to come by in 2023, but DP World, rated Baa2/—/BBB+, pulled off just such a hat-trick with a 10 year deal.

The green sukuk was one of the first priced in September as renewed enthusiasm for emerging market debt was growing but far from assured after a rocky summer of soaring US Treasury yields.

This deal — which was printed with one of the tightest ever levels for a triple-B rated credit — even won praise from rival syndicate managers. They said that the success was little surprise, knowing the calibre of the DP World team and their history of dealing with investors — highly prized credentials in such volatile markets.

Orders hit $3.5bn thanks to the dearth of non-real estate issuance from the Gulf. Making the deal green and a sukuk turbocharged demand, maximising its audience. Investors’ only grumble was the skinny new issue premium; some fund managers put it at zero, while bankers on the deal thought it was 5bp-10bp. Either way, that was unusually small.

CEEMEA Corporate Bond of the Year

GreenSaif Pipelines Bidco

$1.5bn 5.78% August 2032, $1.5bn 6.129% February 2038, $1.5bn 6.51% February 2042 (Formosa)

Global coordinators: BNP Paribas, HSBC, JP Morgan

Bookrunners for 2032s and 2038s: BNP Paribas, Citi, First Abu Dhabi Bank, HSBC, JP Morgan, MUFG and SMBC Nikko

Bookrunners for 2042s: BNP Paribas, Citibank Taiwan, HSBC Bank (Taiwan) and JP Morgan

Gas pipeline investment vehicle GreenSaif reset expectations for Saudi pipeline bonds when it printed its $4.5bn triple tranche deal in 2023, wiping the slate clean after it had been marked by the struggles of EIG Pearl, a similar issuer, to price a deal the year before.

There was nervousness as GreenSaif (A1/A) approached the market for its project finance bond in February.

The only comparable bonds were those from similarly rated EIG Pearl, issued in January 2022. EIG Pearl is an investment vehicle that owns a lease to 49% of Saudi Aramco’s oil pipelines. Like GreenSaif, it issued the bond to repay a loan taken to buy that stake. GreenSaif took out a $13.8bn loan in January last year, due for repayment in 2029.

But the execution of the EIG Pearl deal had not been straightforward. It had sold $2.5bn of senior secured amortising bonds but slashed the size to get the deal over the line and could not tighten pricing from guidance.

It was feared that the same fate would befall GreenSaif if investors struggled with the issuer’s complexity. Instead, it built a spectacular book that hit more than $16bn and crunched pricing by more than 20bp on each tranche.

In doing so, the deal reopened an avenue of financing for similar issuers at competitive levels, reigniting buyers’ interest in Middle Eastern project financing bonds.