Issues

-

Corporates kept pricing dollar deals this week despite equity market volatility, while analysts warned of a reduction in supply

-

Wide spreads have insulated eurozone periphery borrowers from rates volatility — for now

-

◆ Market volatility no hindrance for foreign and domestic FIG issuers ◆ They take advantage of favourable conditions ◆ May volume to end more than 80% higher compared with a year ago

-

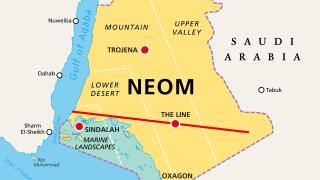

The prices on offer mean little pushback from investors when Saudi Arabia issues more than planned

-

New structures start to emerge and US issuers will be tempted, but some have qualms about Moody’s generosity

-

Barclays sees EMEA as a big part of its growth plan and is investing in senior talent over the next two years

-

Neddies has funded €6bn so far this year and might reappear in dollar market

-

French agency hopes to be a regular in sterling market

-

Big day for Italian ECM as Golden Goose attracts long-onlys to IPO and Chinese shareholder off-loads Pirelli stake

-

Top dogs named as Swiss giant takes next step in Credit Suisse integration

-

◆ New Singaporean names come close to established peers ◆ Deal follows several months of marketing

-

Sheer volume of issuance prevents sensible comparison to peers