Issues

-

China's National Silicone Industry Group has gradually trimmed its stake since 2017

-

Sterling deal on the table for rest of the year, with similar target and strategy for 2025

-

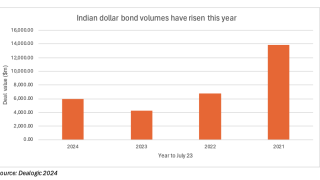

Higher economic growth does not automatically mean sovereigns can pay more on their debt

-

Smaller issuers can access capital market more easily and efficiently through joint vehicle and standard docs, fintech argues

-

◆ New legislation will drive supply ◆ Covered bonds become a crucial part of Polish funding mix ◆ Up to €1bn of fresh paper expected this year

-

Action comes on top of bond misreporting scandal and investigation of alleged malpractice

-

Saudi tipped to be a hot spot for loans in the fourth quarter

-

-

Boon for UK water issuers as Thames woes look contained

-

◆ The A$750m deal, bankers say, shows rise in European Kangaroos ◆ Deal clears despite heightened volatility elsewhere ◆ Oversubscription concentrated in one tranche

-

The government has been stung by uncapped payments to warrant holders

-

Innovation, strong execution and supply dearth benefit Indian issuers