Top section

Top section

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

Jordanian bank wants to move into investment banking

Very few, if any, Gulf issuers are looking at sterling bonds

Data

More articles

More articles

More articles

-

Argentine province already has the approval of 63.7% of its bondholders

-

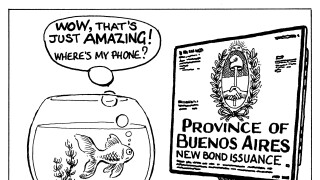

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

Bahrain-headquartered bank the latest emerging market issuer to enter the increasingly busy sukuk market

-

Investors say dollar bonds yet to fully price in uncertainty

-

Bankers say Chilean issuers will dominate early autumn supply from Latin America as Alfa Desarrollo eyes $1.2bn bond

-

The Paris-based banker will be a senior adviser in Lazard's financial advisory business

Sub-sections

-

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa