Top section

Top section

◆ Why emerging market issuers are doing less in dollars ◆ Republic of Congo located between rock and hard place ◆ The GlobalCapital Podcast was brought to you by the numbers 17, 100 and the whole Alphabet

Jordanian bank wants to move into investment banking

Very few, if any, Gulf issuers are looking at sterling bonds

Data

More articles

More articles

More articles

-

Turkish state owned banks are not under government pressure to issue in dollars, said bankers

-

EM bond buyers scramble to put cash to work allows sovereign to print far inside level of last deal from two months ago

-

Buying back debt cheaply does nothing for long-term debt sustainability nor bond market access

-

Lender’s dollar bond could push region’s smaller issuers to “get off the fence” and restart issuing

-

The state-owned export bank drew a book over $1.75bn in a now rare non-sovereign deal from Turkey

-

One investor says more delays in the ‘haphazard’ process will be cause for concern

Sub-sections

-

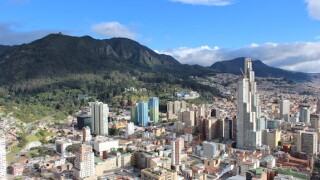

Sponsored by CAF – Development Bank of Latin America and the Caribbean

CAF gearing up to transform regional development

-

Sponsored by Emirates NBD Capital

Emirates NBD Capital: An unrivalled conduit for Middle East liquidity

-

-

Sponsored by European Investment Bank

European Investment Bank: Supporting sustainable development in North Africa