Top Section/Ad

Top Section/Ad

Most recent

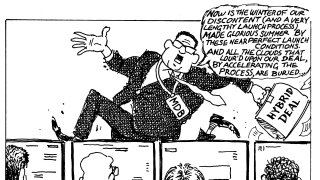

◆ Books grow during pricing ◆ Geopolitical volatility does not derail hybrid deal ◆ Trade prices through fair value, tight to senior

◆ Hybrid books hold firm as senior sales shed ◆ Both tranches land far through fair value ◆ Telefónica achieves tight senior/sub spreads

◆ Peak demand reaches €11.5bn ◆ Longer call tightened harder than the short tranche

◆ Both tranches priced close to fair value

More articles/Ad

More articles/Ad

More articles

-

How the new asset class performs under stress will drive investor confidence and determine its success

-

◆ The first of a new asset class in SSA debt ◆ Full inspection of AfDB's landmark deal ◆ A power shift in the European CLO market

-

Multilateral development banks embark on learning curve of ‘extremely useful and powerful’ instrument

-

New asset class firmly established as AfDB achieves the investor base and pricing it wanted, says treasurer

-

Banque Ouest-Africaine de Développement's deal in December will be followed by more this year

-

The ready and the willing should ride the African Development Bank’s wave while they can