Cartoon

-

Deals from three to 10 years sail through this week as market returns

-

‘Undersupplied’ investors hunger for rare sterling paper from domestic banks

-

Investors are keen on debt-for-nature swaps, but Gabon version shows there are still teething problems for the product

-

Investors don’t like Mexico kicking the can down the road on Pemex, but are happy to take the same approach themselves. This is bad news for everyone

-

◆ Barclays’ bumper senior print proves euro market wide open ◆ US downgrade unsettles sentiment ◆ Dollars still the cheaper market

-

Car maker’s stock has rallied 122% over the past year as it battles to return to profitability

-

Banks are always in someone’s sights, sometimes even their owner's. But look to the bond market, not the newspapers, for whether they are in real trouble

-

There is growing clamour in EMEA ECM for more primary capital raising by issuers

-

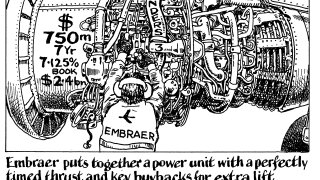

LM component supports demand as Brazilian issuer raises $750m

-

Sellers will compete for buyers’ attention as they fall prey to a confluence of factors

-

The Yankees might be coming as dollar AT1s show allure to foreign issuers

-

Dar Al Arkan, a speculative grade issuer, hit the top end of its size target