Cartoon

-

Issuer prices flat to fair value after building record book while keeping investors onside

-

Despite ADIB's success, many EM issuers will be unable to refinance their AT1 bonds

-

The seasonal shutdown of the primary bond markets is a relic of a bygone era

-

Heathrow and Aeroporti di Roma show sustainability-linked instruments are useful for particular sectors

-

Romania’s electricity producer is reopening Europe’s IPO market

-

-

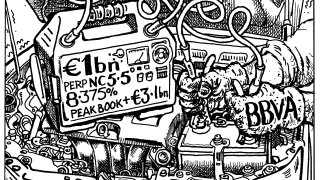

Big name issuers finally return but aggressive approach unsustainable as aftermarket underwhelms

-

Borrower has no plans to get a rating or issue another bond this year

-

Pulling a deal is never an easy decision, but it can be the best one

-

Chilean company is the first LatAm issuer to link coupon step-ups with green use of proceeds in one deal

-

◆ Deal gives hope for more Greek senior issuance ◆ IG ratings appear mostly to have been priced in ◆ Alpha prices tighter than Slovenia's NLB

-

Demand for high yielding paper drives comeback for most subordinated bank capital