Mexico’s finance ministry sent another $3.9bn of cash Pemex’s way in July. This was on top of more than $65bn diverted from public coffers to the state-owned oil giant between when Andrés Manuel López Obrador took office as president on January 1, 2019 and the end of the second quarter this year.

Good news, surely, if you are a creditor, but bond prices hardly budged. In the words of one analyst, investors have short-term solution “fatigue” and the ensuing uncertainty over the next batch of debt maturities.

Still, most EM investors happily take in rather lucrative returns from Pemex, despite knowing that the situation is unsustainable. They are guilty of the same can-kicking.

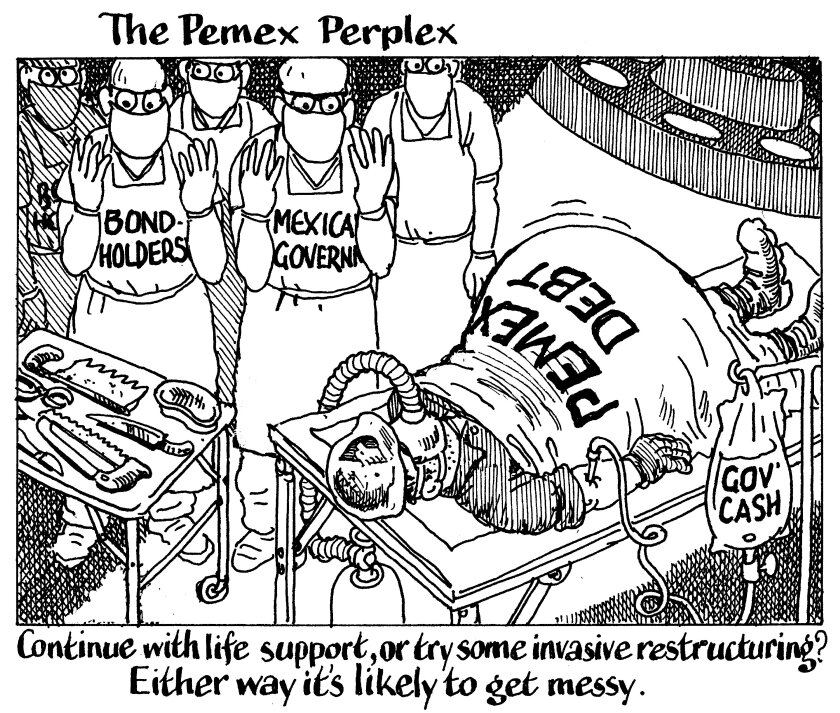

There are not enough al pastor tacos in the world to fuel the brains required to come up with a feasible and sustainable long-term fix for the heavily indebted Pemex. Somehow, it is simultaneously a huge fiscal burden for the government and yet a crucial revenue source. It is also a major instrument of government policy, a big employer, and a political football.

Yet the longer its woes continue, the more brutal the fix is going to be. Whether the burden is ultimately born by the Mexican government, Pemex employees and pensioners, or creditors, it is only becoming more expensive for the company to refinance its debt. And operational mishaps will pile up as the shortage of capex gets longer.

Any normal company with Pemex’s credit metrics would restructure its debt. Mexico is hesitant to do this because of the impact it would have on the country’s capital markets standing.

But what if bondholders took it upon themselves to take the initiative and propose a solution? This could include taking a short-term financial hit via haircuts or maturity extensions. They could pair it with conditions to ensure the company turns around, such as allowing private sector investment, ESG improvements, or higher productivity.

It would make the company a better investment and enrich Mexico, which will complete a virtuous circle as many of those creditors will have other big investments in the country.

Bondholders pre-empting a restructuring might like shooting themselves in the foot but taking the initiative will help bring a swift and amicable solution, rather than a bitter, elongated, politicised feud.

This is no esoteric problem, either. Pemex’s $80bn of paper represent about 10% of all emerging market corporate bonds. A default or prolonged restructuring would be unthinkable for the asset class.

For everyone’s sake, the fix should come as soon as possible, and bondholders are well set and incentivised to start the process.