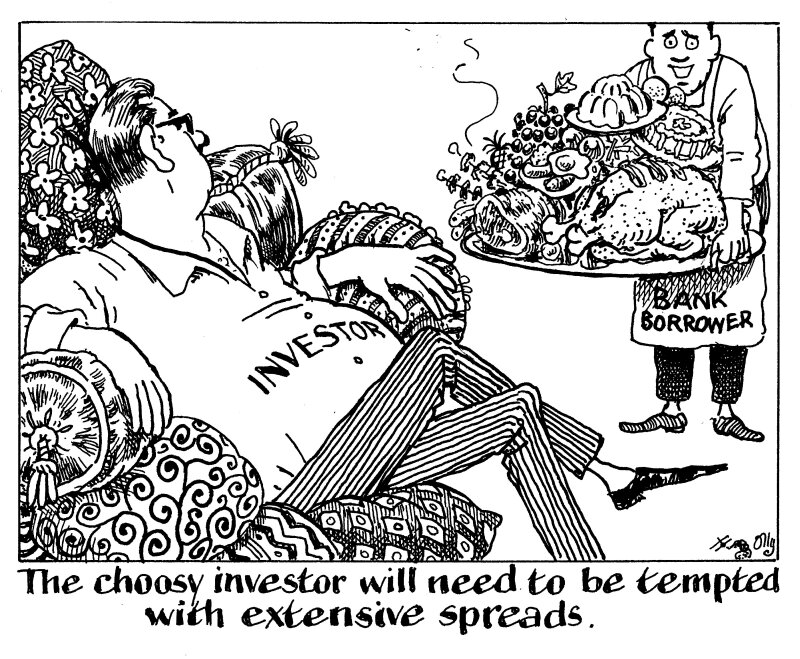

New issue concessions in the covered bond market may narrow from the 6bp-8bp range paid this week as issuance slows but with borrowers jostling for attention, there is a strong chance they will not stay there, as investors realise they can be choosy.

Banks have had a good run this year, taking advantage of cheap deposit funding and high rates to boost profits. But a drop in deposits is outpacing the fall in lending, S&P pointed out this week, meaning wholesale funding needs will remain acute.

The squeeze on net interest margins and deposit depletion will come just as economic activity reaches a plateau, before contracting. And as credit conditions worsen, senior unsecured funding costs will escalate, causing banks to pivot towards the cheapest source of wholesale funding, namely covered bonds.

At the same time, issuers will no longer have the luxury of European Central Bank support, as it stopped buying covered bonds at the beginning of this month. And even after June’s hefty €472bn repayment of the ECB’s TLTRO, banks will still need to repay almost €600bn by the end of next year.

If that wasn’t enough, some members of the ECB’s governing council are said to be frustrated by the central bank’s glacial pace of balance sheet shrinkage and have discussed selling bonds from the Asset Purchase Programme, which includes a portfolio of around €300bn covered bonds.

Moreover, on the assumption that a peak in interest rates will cause the euro swaps curve to disinvert, it is likely that demand for covered bonds, hitherto limited to the short end of the curve, will extend. This will bring a further avalanche of supply from issuers who have been waiting for just that.

The upshot is that issuers will continue to play second fiddle to investors who will, without doubt, continue to call tune.