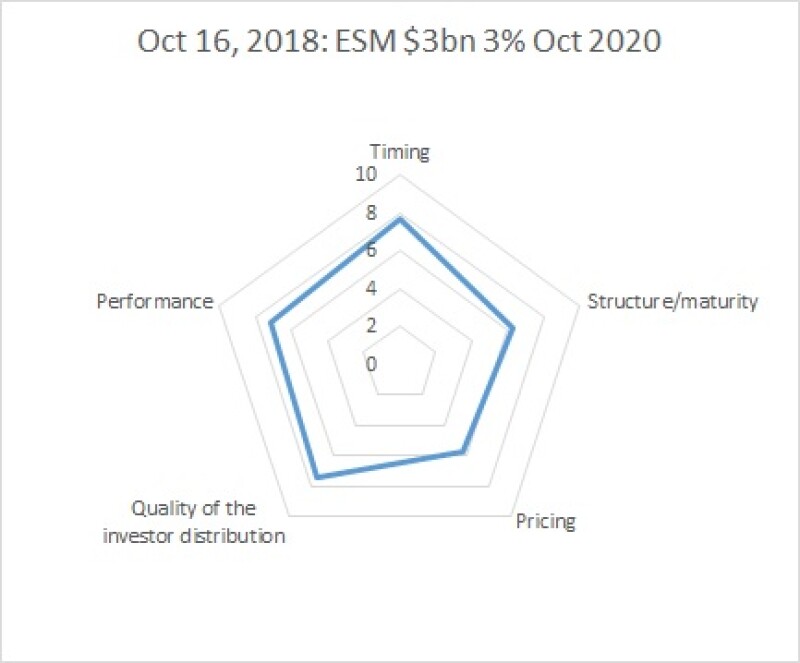

ESM’s $3bn two year Reg S/1$$A, the only deal for scoring in the week commencing October 15, took a particular hit on pricing, for which it scored 5.75. It also underperformed in structure/maturity, for which it received 6.25. That was in keeping with comments at the time of pricing, with some on-looking SSA bankers saying the maturity was too short.

The trade scored much higher in timing (7.63), quality of investor distribution (7.38) and performance (7.13).

Bank of America Merrill Lynch, Barclays and Citi were leads.

ESM’s deal is not alone in faring poorly relative to deals in the first half of the year. Trades from some of its peers have also struggled in BondMarker over the last few weeks.

You can have your say on last week’s deals — Alberta’s $2.25bn five year global, EIB’s $3bn five year global and JBIC’s dollar dual tranche — on BondMarker until voting closes at 6pm on Thursday.